While talking about TIG welders, we generally think about the best TIG welder for the money. Of course, everyone wants a good return on his payment.

Alternatively speaking, we want a product that is worth the money.

Do you know?

Until the last week, we were also the searcher of this query. So, we had done as strong research as we could. With the aim to find the best TIG welders on the market, we interviewed multiple professionals.

As a result, we found some common names with maximum positive reviews. We have tested and analyzed the top 10 products that have beaten their competitors.

Would you like to have a look?

We thought it’s good to share our findings with our hands-on experience. So here are our findings.

Make joints of all types of Metals with the Best TIG Welder.

These are some hot names of TIG welders that deserve your attention. Just scroll to the next part and find what makes them unique.

How We Choose The Best TIG Welders for the Money?

A large population goes for the best TIG welders, but you should clear some hot questions before going for a purchase. So, these include your budget, the kind of metals you most deal with, and the key purpose for which you are going for the welder.

Let us answer these questions step by step.

Type of metal in question

This is the most important question to which professionals put big attention. The metal strength and texture vary from kind to kind.

Therefore, the sheet varies from thin to very thick. As a result, you should get the product accordingly. For example, a thin plate of stainless steel gets disturbed by the heat produced in MIG and Stick welding.

Alternatively,

TIG welding is a good choice for this kind of metal. So, be focused on the project you mostly have to deal with. Yeah! It is a great way to make your choice easy among the vast options available.

Purpose of welder

Furthermore, the welder machine is made to deal with a large variety of tasks. No doubt, the aluminum plate can be welded easily with DC. But, why experts have introduced AC.

Well, the answer to this question is super easy.

It is the production of pulse waves by AC that makes it functional. Finally, you get super clean welding results. Furthermore, TIG welding has a unique profile that decreases the heat intensity. So, thinner surfaces do not disturb.

Safety and protection

Dealing with current, voltage, and heat may be dangerous. So, never bypass safety features while purchasing a welder.

Thus, if you are a regular user of a welder; the safety functions would be in your knowledge.

Yes,

Multiple brands offer protection from over-current, in addition to over-voltage and over-heating.

The price that you can afford

To purchase a good welder, try to fix a good amount of dollars. You know, everyone uses this product once and does not go for the next in a couple of upcoming years.

So, ensure quality and protection by spending some additional money. In contrast, for a general home need, you can fix a small budget. But professional work needs a next-level quality and performance.

Here are the top 10 Best Tig Welders for the Money.

| Image | Product | Feature |

|---|---|---|

| Lincoln Electric Square Wave TIG Welder | AC/DC: Yes Amperage: 10A to 200A Duty cycle: 60% at 130A, 40% at 160A, 25% at 200A |

| WeldPro MIG200GDsv MIG, TIG, Stick Welder | AC/DC: DC only Amperage: 10A to 200A Duty cycle: 30% at 200A, 100%t at 110A |

| ANDELI Al Suit Aluminum TIG Welder | AC/DC: Yes Amperage: 10A to 200A Duty cycle: 20% at 200A, 60% at 115A, 100% at 89A |

| Mophorn Tig-200 Welder Machine | AC/DC: DC only Amperage: 20A to 200A Duty cycle: 60% |

| LOTOS TIG 200A AC/DC Aluminum TIG Welder | AC/DC: Yes Amperage: 15A to 200A Duty cycle: 60% |

| SUNCOO TIG 200CP Welder Machine | AC/DC: DC only Amperage: 10A to 200A Duty cycle: 60% |

| Mophorn ARC250S TIG Welder | AC/DC: DC only Amperage: 20A to 250A Duty cycle: 60% at 250A |

| S7 TIG-200A Dual Voltage Welder | AC/DC: Yes Amperage: 20A to 200A Duty cycle: 85% |

| Everlast PowerArc 140ST TIG Welder | AC/DC: DC only Amperage: 10A to 140A Duty cycle: 35% |

Best Profesional Tig Welder  | Everlast PowerTIG 255EXT Digital Welder | AC/DC: Yes Amperage: 5A to 250A Duty cycle: 60% at 250A |

1. Lincoln Electric Square Wave TIG 200 Welder – Best TIG Welder for Aluminum

Go for TIG and Stick welding with the single unit, Lincoln Electric Square Wave TIG Welder. Therefore, from thinner to thicker material, every type can be welded. You are ready to deal with this Best TIG Welder for Aluminum and other versatile metals.

Furthermore, get ready to weld using its AC and DC options based on the type of metal.

Wait, something is amazing to show you.

Now, fulfill the need for greater power based on your work. Congratulations! You can enjoy your work with dual voltage. It serves you with a higher power of 230 volts, in addition to the standard 120 volts.

Lets explore the interface

At the first sight of a professional on this welder can identify its simplicity. This is so, the company has designed its interface very easy to understand.

As a result, many hobbyists and beginners prefer to buy this Lincoln Electric product.

Moreover,

It is engineered with advanced functions that a good welder can provide. But can you identify an additional plus point? Well, this advancement does not affect its usage.

For your knowledge, neglecting its advancement, it is still easy to use.

We know, you are appreciating this feature.

From indoor to outdoor, drag or lift it anywhere you want. Plus, portability is always here to support you. So, put it in your workplace, plug in the switch available, and go to work with confidence.

ADDITIONAL FEATURES

Some other features have made this Lincoln product more attractive. These are;

- It comes with pulse mode.

- Arc can be started with zero contact.

- This welder is designed on inverter technology.

- The integrated knob at the heart allows basic adjustments.

KEY SPECIFICATIONS

- The total weight is 73 pounds

- The dimension is 22 x 13.1 x 21 inches

Pros

- The interface is too simple

- Dual welding functions

- Multiple adjustments

- Ideal for aluminum

- Portable design

- Light in weight

Cons

- Price is high

- Not for a larger project

- Minimum voltage is high for some task

In short, this welder is good for beginners who need simple functions. Plus, the advanced functions are easy to use and multiple metals can be deal with it. The price is high, but it definitely worth the money.

2. WeldPro MIG200GDsv MIG, TIG, Stick Welder – Best Portable TIG Welder

Introduce yourself to an advanced welder that is 3-in-1. Now, you are thinking about what is available in this triple package. So, we announce proudly that our selected welder can offer you MIG, TIG, and Stick welding without any additional product.

So, buy it and check for feasibility as it has a warranty duration of 3 years.

Honestly speaking,

You do not need to depend on a foot pedal to use a TIG welder. Furthermore, the other type of welding process also does not need additional elements.

With the small work location, you should go for WeldPro MIG200GDsv. The reason behind this recommendation is its compact profile.

You look a bit curious. That’s great! You should be.

In addition, the dual voltage is here to support diverse functions. You would be more interested to know that it is a multi-processor unit that is adorned with inverter technology.

In short, WeldPro MIG200GDsv is the Best TIG Welder in the World that offers versatile functions.

ADDITIONAL FEATURES

Some features have made this unit a hot choice to pick in the TIG welder market. These are;

- It works well with a maximum output of 200 Amps.

- It comes with supportive elements

- The construction is of metal

- The technology is inverter-based.

- The warranty time is 3 years.

KEY SPECIFICATIONS

- The weight is 30.4 pounds

- The dimension is 17.72 x 8.66 x 14.96 inches

Pros

- Offer three welding types

- Well explained manual

- Enhanced accuracy

- Design is compact

- Usage is easy

Cons

- The run wire is random

Finally, we say this is a very strong and versatile welding machine. In addition, it uses advanced technology to impress you more. In your small workplace, it will be a Best Portable TIG Welder.

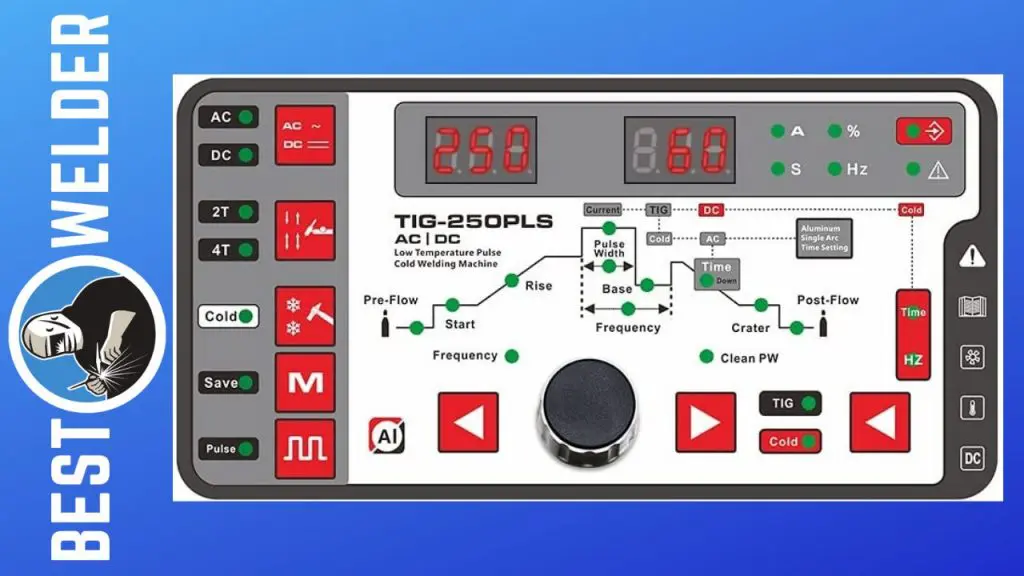

3. ANDELI Al Suit Aluminum TIG Welder – Best TIG Welder for Thin Metal

ANDELI is another famous name that is offering a cold welding machine. The point to be noted is that this unit can work on dual voltage; 110 volts and 220 volts.

Moreover, two pairs of modes are engineered in this product. These include; cold pulse, HF TIG, cold welding, and pulse TIG.

That’s great!

In addition, these modes make it very suitable for stainless steel, aluminum, and other metals that are thin.

Furthermore, enjoy good control with the help of multi-mode selection.

There is some more information for you to know.

This welder can work with AC and DC power sources. Thus, this feature makes it Best Budget AC DC TIG Welder and competitive in the welding world. In short, if you are looking for a good welder for thin metals, your search ends here.

ADDITIONAL FEATURES

These are some amazing features of ANDELI Al Suit Welder that make it a worth buying option.

- The display is digital to ensure accuracy

- It comes with integrated parameters

- The current required is 200 Amps

- Cold welding needs pure argon

- It can deal with color change

KEY SPECIFICATIONS

- The weight is 40 pounds

- The dimensions is 23.62 x 17.72 x 13.78 inches

Pros

- Offer cold spot welding

- Ideal for professionals

- Multiple functions

- Fit for thin metals

- Safe to use

Cons

- The price is high

- The weight is not less

Finally, we have found that the discussed welder machine is a good choice if you want to bypass color changing. The price is high, but you would proud of the results produced by this machine.

4. Mophorn Tig-200 Welder Machine – Best Budget TIG Welder

Meet this great combo of TIG and ARC Stick welding machine that offers the adjustment of output current with the help of a knob. The current range for TIG welding is 20 to 200 Amps.

Plus, the welding functions are very too versatile to make it a preferable unit.

Exploring more features,

In addition to aluminum, it can weld stainless steel, chrome, steel, and titanium of 3/8 inch thickness. Furthermore, the control of voltage fluctuation is very excellent.

Plus, the dual voltage control is another very fantastic function that switches between 110 and 220 volts.

Are you continuous about protection?

That’s great. Here is a piece of good news for you. This welder of our choice is too safe to use. In addition, to manage over-heating, this machine can overcurrent and overvoltage. Thus, we confidently say this safety feature has made this product of Mophorn a very interesting product in the welder market.

ADDITIONAL FEATURES

When going for some additional features, we found some very unique aspects. These are;

- The current decay time is adjustable from 0 sec to 10 sec.

- It is used to process metal sheets and multiple others

- Gas delay time can be adjusted between 0 and 15 sec

- The stated welder works on an IGBT DC inverter

- This welder comes with a strong cooling system

KEY SPECIFICATIONS

- The weight is 21.1 pounds

- The dimension is 15.7 x 6.3 x 11.4 inches

Pros

- The performance is great

- Multiple applications

- Protective to use

- Light in weight

- Very portable

- Manages heat

Cons

- Not for professionals

- Need fixation before use

Finally, this welding machine is found to be a good combo of TIG and Stick functions. The dual voltage allows its diverse usage. In addition, it is a good choice for beginners who looking for the Best TIG Welders Under 500.

5. LOTOS TIG200 ACDC Aluminum TIG Welder – Best TIG Welding Machine

Meet with another Best Aluminum TIG Welder that is very famous for accurate welding. With 80% efficiency of power, it is suitable for thin metals.

In addition to good heat control, it is integrated with hand torch control.

A very good point,

The cooling system is very advanced to make you feel proud of your selection. Moreover, the plasma cutter offers amazing performance with nicer durability.

Furthermore, the voltage offered is dual which includes 220 and 240 volts. Plus, dual-frequency is another very supportive point served by this welding machine.

In addition, the frequency is 50/60 Hz.

Are you interested to know more features?

This is a Square wave welder that comes with Argon regulators and a foot pedal. So, it is a great aluminum welder that comes with other additional components.Finally, we declare it the second-best TIG welder that is good for aluminum.

ADDITIONAL FEATURES

The most famous aspects that have made LOTOS TIG200ACDC very famous in its breed are;

- Persist in basic and acidic electrode

- Built on a square wave inverter

- Arc current can be adjusted

- Dual voltage is automatic

KEY SPECIFICATIONS

- The weight is 58 pounds

- The dimension is 28 x 13 x 17 inches

Pros

- The cooling system is advanced

- Power efficiency is excellent

- Very durable and strong

- Performance is great

- Accurate results

Cons

- Weight is high

- Size is big

In short, this model of LOTOS is very efficient and offers nicer performance. With enhanced efficiency, it is very safe to use. In addition, the tag price is not too high. You can afford it with a medium budget.

6. SUNCOO TIG 200CP Welding Machine – Best TIG Welder for the Money

Give yourself a huge favor by purchasing a SUNCOO TIG 200CP welding machine. In addition to TIG welding, you can go for Stick welding.

Furthermore, starting the arc is super easy and takes no time.

Have you noticed what the company has introduced to inspire you?

So, weld what you want and there would be the least voice. Is it not super amazing? Well, it is not the only feature. In addition, there would be the least spatter also.

Congratulations, your welding results would be super smooth, in addition to a nicer appearance.

It’s time to explore the metals that SUNCOO can weld.

This welding unit can weld copper, carbon steel, and stainless steel. Additionally, it comes with a quick button that allows you to switch between TIG and Stick with a single pressing. Furthermore, the operation is too simple to inspire you more and its inverter technology makes it the Best Inverter TIG Welder for home use.

Now, sit and think about what features have inspired you most.

Further, it is designed with MOSFET inverter technology. Moreover, the dual voltage has made this unit more versatile. In addition, an LED screen is engineered to give you an update about amperage.

ADDITIONAL FEATURES

So, these are some nicer features that never fail to make it a preferred product.

- It comes with MOSFET inverter technology

- It provides IP21S level protection

- Compensate voltage fluctuation

- Need 200 Amps for functioning

- The duty cycle is 60%

KEY SPECIFICATIONS

- The weight is 27.3 pounds

- The dimension is 18.4 x 13.9 x 9.9 inches

Pros

- Good heat dissipation

- Enhanced energy

- Portable profile

- Light in weight

- Less in price

Cons

- Zero wiring guidance

- Not for professional use

This welding machine offers good protection in addition to quality results. Moreover, it is designed with an LED screen to ensure accuracy. In short, it comes with all the necessary features that one can demand.

7. Mophorn ARC250S TIG Welder – Best TIG Welder for Beginners

Explore another Mophorn welder that would make your experience very amazing with its lightweight design. The strong steel composition makes it durable.

Plus, this product is compact to fit in your smaller workplace.

Don’t ignore the next features. These may change your mind…

Unlike other very complicated welders, Mophorn ARC250S is very simple to operate. So, it is a gift for beginners. Thus the simple operation emerges questions about performance.

Don’t worry!

The easy usage does not mean the manufacturers have made compromises over performance. If you are thinking so, just relax. The performance of this machine is still appreciable.

Moreover, it has been engineered with next-level IGBT module technology. So, you have just read about the space-saving feature.

Here is a piece of good news for you.

In addition to the compact profile, it saves power with 85% efficiency. Is that feature impress you? So, reliable on this super amazing machine and continue your work for a longer time.

Furthermore, the other cool features are a convenient control pool, firm electric arc, and strong thrust.

ADDITIONAL FEATURES

Some advanced features have made this cheaper product a choice for home users. These are;

- This machine brings dual voltage (110 volts & 220 volts)

- It is integrated with technology for voltage compensation

- This welder is based on a PWM control system

- It comes with a knob to customize arc current

- A heat dissipation fan is integrated at the back

KEY SPECIFICATIONS

- The weight is 14 pounds

- The dimension is 18.43 x 13.78 x 10.63 inches

Pros

- Overheating indicator

- Strong construction

- Protective to use

- Light in weight

- Less price

Cons

- Not for harder tasks

- It is just DC welder

As a result, this welder is portable and safe to use. Moreover, advanced technology has made it a preferable product for DIY users. This, if you want something good in less price, Mophorn ARC250S is good for you.

8. S7 TIG-200A Dual Voltage Welder – Best TIG Welder on the Market

Introduce your profession with an emerging name, S7. The discussed model of this brand offers a fast result. So, the company has done its best to ensure the perfect results.

In addition, a good point to note is that this fast welder generates the least possible spatter. So, you do not need to worry about the post-weld mess.

You can explore more features if you want to give S7 a try.

With an 80% duty cycle, this unit ensures optimum performance. Moreover, it is a dual welder that includes TIG and ARC welding.

You know! TIG welder is specifically instrumental for thin metal sheets. So, this welder can manage thickness between 0.3 mm to 4.8 mm.

On the other hand,

The thickness of ARC welding is 15 to 42 mm. In addition to stainless steel, chrome, mild steel, alloy steel, cast iron, and copper can be treated with the TIG face of this welder.

In brief, it is portable to use and saves energy and space very efficiently.

ADDITIONAL FEATURES

So, these are some prominent features that enable this welder to compete.

- It comes with a digital display for current

- It is integrated with IGBT technology

- The inverter frequency is 100 kHz

- It is good for non-ferrous metals

- AC ranges from 90 to 260 volts

KEY SPECIFICATIONS

- Weight is 22.4 pounds

- The dimension is 19.76 x 13.94 x 10.79 inches

Pros

- Save power and energy

- Good performance

- Light in weight

- Dual welder

- Less spatter

Cons

- Not for aluminum

- Gas fitting is not good

- Not work for thicker tungsten

Finally, we say that this welding machine is convenient to use and offers flawless results. Moreover, it provides enhanced performance and produces less spatter in the workplace.

9. Everlast PowerArc 140ST TIG Welder – Best Inverter TIG Welder

Know about another brand, Everlast Welders Canada. You can place this unit anywhere you want. In addition, the design is very compact to make it portable and the Best Small TIG Welder.

Moreover, it brings with it a carrying case that includes additional accessories, in addition to the main product.

Do you love Everlast?

Like other famous welders, the discussed product also offers multiple functions. So, you can carry on Stick and ARC in addition to TIG.

Moreover, the TIG function brings with it a 17-series torch for the gas valve.

Are you curious about more features?

Thus, these features have made it very simple and easy to use. Moreover, the front face is housed by an LED screen to give you an update about the current. Plus, a knob is integrated for further adjustments.

Furthermore, it comes with an automatic hot start to provide enhanced ease. In addition, it is flexible to use and offers optimum performance.

Exploring more,

Though this unit is small, keep in mind the arc stability is not compromised. Plus, you need to purchase a gas regulator you use in its TIG mode.

ADDITIONAL FEATURES

Everlast is a famous name that comes with some hot features. These include;

- The digital display for current is present on the front panel

- It is integrated with IGBT inverter technology

- It can work on dual voltage

- The duty cycle is 35%

KEY SPECIFICATIONS

- Weight is 24.8 pounds

- The dimension is 20 x 12.5 x 13.5 inches

Pros

Cons

In short, this welder has less price with advanced technology. In addition to dual voltage, it offers a dual function. If you are looking for a portable product, Everlast PowerArc 140ST TIG welder is a good choice for you.

10. Everlast PowerTIG 255EXT Digital Welder – Best TIG Welder for Professionals

Meet another module of Everlast that can manage the heavy load. So, you can rely on it for professional work. In addition, use this upgraded product of 2024 and it would not lead down in terms of performance.

Moreover, an IGBT inverter technology has been designed to make you confident.

Do you want to know more about our last product?

So, exploring its design says that the discussed welder comes with a very simple profile. As a result, you can customize it according to requirements with great ease.

Furthermore, the lowest working temperature for AC is 5 Amp. On the other hand, this temperature for DC is 3 Amp.

You look curious to know about its waveform.

Well, it includes Soft Square, sine, triangular, and advanced square. To your surprise, this broad variety of waveforms is not offered by other welders in the market.

On the other hand, it can be said that the mentioned product has beaten its competitors in this scenario.

ADDITIONAL FEATURES

So, this latest module of Everlast comes with some additional features that make it unique among its class. These features are;

- AC pule is improved to deal with thicker metals

- The voltage is dual including 110 and 220 volts

- It has an integrated digital screen on the front

- It is engineered with IGBT technology

- This welder works with AC and DC

KEY SPECIFICATIONS

- The weight is 85 pounds

- The dimension is 24 x 9 x 17 inches

Pros

- Excellent performance

- Multiple waveforms

- Strong composition

- Dual power source

- Startup is easy

Cons

- Weight is high

- Not for beginners

In the end, this latest model of Everlast is a good option for professionals due to its diversity. Its functions are versatile and the composition is strong. This is the Best TIG Welder Under 2000 So, you can get it with a good budget.

What are the TIG welders for the money?

All those welders that provide all the necessary features on a low budget with good safety and a high duty cycle can be regarded as the best TIG welders for the money.

Name the welder that is good for aluminum

A larger number of welders are available in the market that fit best with aluminum. But, we found two names on our list. These are; Lincoln Electric Square Wave TIG200 Welder and LOTOS TIG200 ACDC Aluminum TIG Welder.

What makes TIG welder expensive?

TIG welders are expensive due to tungsten electrodes. These are stronger and more powerful than the other types. Moreover, they come with a great capacity to heat metal at an extended rate.

We have reviewed the Best Welding Jackets you must use while welding.

Our Verdict & Recommendations

Finally, we have done the discussion on the Best TIG Welder for the Money. Our findings say that a large variety of welding machines are available in the market.

Some names have made up the mark while others are emerging. On the other hand, some brads have just stepped in welding word.

As a result,

All these names do not return your money with next-level performance. There are some famous names with nicer features. So, these can be placed in the list of the best TIG welder for professionals or the Best TIG Welder for Beginners.

In the end, we would like to say that you should have a piece of proper knowledge before final purchase.

We hope you would visit again soon.

Our Recommendations

If your budget is strong, then the preferred product should be Lincoln Electric Square Wave TIG Welder. It is a unique combo of advancement and convenience.

On the other hand,

If you need a welder for your home, or your pocket is narrow; simply go for the SUNCOO TIG 200CP Welding Machine. It is not only safe to use but also provides diverse functions.

Related Posts:

- Best 8 Welding Gloves 2024 – [TIG, MIG, STICK] Expert Reviews

![Best 8 Welding Gloves 2024 - [TIG, MIG, STICK] Expert Reviews Best 8 Welding Gloves 2024 - [TIG, MIG, STICK] Expert Reviews](https://welding-world-awards.com/wp-content/uploads/2023/12/top-8-welding-gloves-for-tig-mig-and-stick-welding-150x150.png)

- 5 Best Welding Respirators – [Welder’s Mask] Expert Review 2024

![5 Best Welding Respirators - [Welder's Mask] Expert Review 2024 5 Best Welding Respirators - [Welder's Mask] Expert Review 2024](https://welding-world-awards.com/wp-content/uploads/2023/11/top-5-welding-respirators-150x150.png)

- Top 10 Best Welding Helmet 2024 – Reviews & Budget Friendly

- Best Welding Boots 2024 – [Welded Shoes Ultimate Buyer Guide]

![Best Welding Boots 2024 - [Welded Shoes Ultimate Buyer Guide] Best Welding Boots 2024 - [Welded Shoes Ultimate Buyer Guide]](https://welding-world-awards.com/wp-content/uploads/2023/12/image-150-150x150.webp)

- 6 Best Welding Jackets – [Leather Weld Coat] Top Picks 2024

![6 Best Welding Jackets - [Leather Weld Coat] Top Picks 2024 6 Best Welding Jackets](https://welding-world-awards.com/wp-content/uploads/2023/11/skrinshot-24-12-2023-234941-150x150.webp)

- Best TIG Welder for Home Use – Reviews + Buying Guide 2024

- Best Inverter TIG Welder – Reviews & Buying Guide (2024)

- 5 Best TIG Welders Under $500 – Reviews & Guide (2024)

- Best TIG Welder In The World – Top Picks & Guide (2024)

- Best Lincoln TIG Welder – Reviews & Buying Guide (2024)

- 5 Best TIG Welders Under $1000 – Top Picks & Guide (2024)